In its first seven years of existence, Uber has irked cities, flouted regulators, and petrified whole industries. It has yet to make money but is worth a fifth more than BMW and almost a third more than General Motors, both the owners of tons of futuristic technology, tens of billions of dollars in capital equipment, and big profits. In recent deals resembling famous speculative bubbles, rich investors eager for a piece of this juggernaut have poured hundreds of millions of dollars into custom funds that provide exposure to Uber but no equity or financial disclosure.

Which is to say that investors have made a one-way, uber-bullish bet on Uber, forecasting that the company will be at the center of an utter transformation of our collective lifestyle. If not everyone is betting on it, they’re at least not betting against it. We can state that with some certainty because even if you want to short Uber—which you might wish to if only to hedge or to take on a bit of high-end risk—it is generally thought impossible to do.

But what if the consensus has miscalculated? What if the coming trends expected to propel Uber—primarily a decline in private vehicle ownership and the rise of self-driving, clean-powered cars—do generally unfold, but not quite transformationally? What if they take much longer to materialize than anyone is expecting?

And what if Uber’s dramatic decision to surrender the pivotal Chinese market to local rival Didi Chuxing, announced on Aug. 1, halts the momentum that has heretofore been a crucial piece of the American startup’s story?

Until now, auto and tech giants, investment banks, think tanks, and expert consultants have generally agreed that, just as Google appeared out of the blue to own search, Apple to revolutionize smartphones, and Amazon to capture online commerce, Uber was likely to be the singular name in shared transportation. But in light of its retreat in China, it seems more likely that the company will be, at best, part of a shared triumph.

Indeed, the company is grappling with local competitors in markets around the world—among them Lyft in the US, Ola in India, and Fasten in Russia. They also are raising tons of capital and nurturing global ambitions of their own. Among the tens of billions of dollars anted up for a share of the action, GM has taken a $500 million stake in Lyft, and Apple has invested $1 billion in Didi Chuxing, which itself is about to invest a reported $100 million in Malaysia’s Grab.

Uber would argue that its potential goes well beyond ride-hailing, that it has uniquely large-scale ambitions to be a logistics firm, using its fleet and its technology to deliver food and packages in cities around the globe—like FedEx, only with robot cars.

But what if Uber accomplishes this and is still not worth its current $62.5 billion valuation, or even the $16.2 billion in cash that investors currently have at stake?

In his best-seller The Big Short, Michael Lewis featured the inventive investors who figured out how to bet against the housing bubble that preceded the 2008 financial crisis. If an investor could similarly build a case against Uber, and was right, there might be few contrarian bets in Silicon Valley that would deliver as rich a payday.

Should savvy opportunists now be figuring out how to make a tidy profit betting against ride-hailing? The answer, I determined, is yes. The conundrum was how.

Part I: Self-driving technology is indisputably on its way

Every major automaker on the planet, in addition to tech giants like Google and Apple, is developing self-driving technology as fast as it can. Already, cars produced by BMW, Tesla, and Toyota can guide themselves along major thoroughfares, and slide perfectly into a parallel parking space.

Experts dispute how fast such capabilities will become standard equipment in mainstream-priced, fully autonomous vehicles. Tesla CEO Elon Musk predicts it will be in just a couple of years; Kia and Mercedes say it is more probable in the 2030s. Other forecasts are in the decades after. But the conviction of all is that self-driving cars are the future.

The bet on Uber is that this trend will converge with an increased shift to the ”sharing economy.” In this broader vision, personal transportation will come to be dominated by autonomously driven cars. Starting as soon as a decade and a half from now, large numbers of people around the world will get around by hailing driverless taxis that operate like robots, so ubiquitous that they will arrive an average of a minute after being summoned by an app. Or we will own a contract conferring privileges in a robotic vehicle shared by numerous others. Whichever the case, households will own at most a single car, or stop buying them entirely, and sales may plunge almost in half.

There is logic to this view. Analysts making the case usually start with the nonsensical way we own cars: Autos are our second-largest investment after a house, yet we barely use them. Presented with a more rational alternative, adults around the world will naturally discard their old ways. The residents of cities in the industrialized world will be first to rush into this lifestyle choice, mostly out of frustration with obsolete infrastructure, and those in the developing world will be next. “Gridlock will be so horrible that people won’t consider buying a car,” said Alejandro Zamorano of Bloomberg New Energy Finance, which analyzes trends in energy technology.

In a recent note to clients, Barclays analyst Brian Johnson wrote:

The average vehicle is only driven 56 minutes per day–that is, 4% of the time. Even at peak hours, only about 11% of vehicles in a highway-intensive city like Seattle are in use. Accordingly, a significant opportunity exists for asset utilization to increase via sharing of self-driving vehicles.

It’s the shift implied by Johnson—shedding the drivers—that most of all accounts for the big bet on Uber.

In the remote chance that you have only vaguely heard of Uber, it is an alternative to Hertz and taxis. You open an app on your smartphone, and within a few moments, a private driver, one who has signed on as a contractor with Uber, shows up precisely where you are standing and takes you to your destination. No cash changes hands (unless perhaps you’re in Africa or India) because your credit card is on file.

According to confidential documents obtained by The Information (paywall), Uber took in $1.2 billion in revenue in the first three quarters of last year, but still lost almost $1.7 billion. Much of Uber’s spending goes to compensate its drivers. According to a May 2015 report by Barclays, the omission of drivers will reduce the total fixed operating cost of a new ride-hailing vehicle to 34 cents a mile, down from 81 cents today, meaning that Uber will save about 47 cents a mile from the advent of robot cars. So if it can cement its hold around the world, and be rid of those people behind the wheel—if all or most of its cars are propelled by robots, and it will simply be paying to insure and maintain them—its profit should be astronomical.

Hence the automation/ride-hailing thesis: If the market embraces the two advances more or less equally, Uber investors should score a financial bonanza. But to the degree automation develops more slowly than ride-hailing, the windfall would be much less.

When analysts and the carmakers themselves get to talking about this subject, they are prone to forecast the fast robotization first, and from there become fairly excited. Such bulls say that transportation network companies, as they call firms like Uber, are central to an inevitable shift that places ride hailing, vehicle sharing, and autonomous driving technology, rather than cars themselves, at the center of the automobile business. For the major carmakers, that could mean catastrophe, while for Apple, Google, and other tech giants with ambitions in the same field, the revolution could mean a significant new stream of income.

The believers are not shy about forecasting large returns. According to Morgan Stanley’s Adam Jonas, we are talking a $10 trillion-a-year industry. And according to Rolls Royce (paywall), in a quarter century, “everyone will be chauffeured by robots.”

The widely accepted narrative is that Uber will have a significant share in all of this.

Part II: Forecasting and being right are different things

In a June 17 note to clients, analyst Bob Brackett of Sanford Bernstein argued that the world may not be making a massive shift to ride-sharing. Brackett, who has a record of dry contrarianism that he calls realism, suggested that, in invoking a cognitive connection between autonomy and ride-sharing, fellow analysts are committing a “conjunction fallacy,” invalidly linking one trend to another.

US Census data, Brackett said, shows carpooling in the US plunging over the last three and a half decades, from 19.7% of all commuters in 1980 to 9.4% in 2013. If Americans are so prepared to share cars with other human beings, why are fewer of them doing so now than a generation ago? He went on:

Yes, cars are “inefficient”—used only 5% of the time for example. But so is art. And so is jewelry, and I’ve yet to convince my wife to rent it. So are golf clubs but we still buy them. Toothbrushes are used less than 1% of the day, and a perfect app I’ll develop called Gumbuddy could find neighbors willing to share for a modest fee. I’d argue that automobiles in the American tradition fall closer to a personal and emotional item.

A 2015 study by JD Power tends to back up Brackett. One of its primary conclusions is that American millennials, the generation said to be most eager to renounce car ownership and share, are still buying vehicles, and a lot of them. This age cohort in fact accounted for 27% of all US car sales in 2014, compared with 18% in 2010, the firm said.

A May survey by University of Michigan researchers Brandon Schoettle and Michael Sivak found that, at least for now, American motorists aren’t in fact keen to be driven around by a robot, either. Just over 15% of respondents embraced the idea of a fully self-driving car. Those aged 18 to 29 showed only slightly more enthusiasm, with fewer than 19% wanting a completely autonomous vehicle, and a solid 41% preferring no self-driving features at all.

Autonomous driving and car-sharing have been combined into a single narrative, but they may not belong together. That autonomous functionality is coming to our cars is manifest—we can watch the car companies moving to install and offer these features (although a fatal May 7 crash in Florida involving a self-driving Tesla S suggests that fully autonomous, robotic cars will not be ubiquitous as soon as the consensus thinks). But not so much car sharing: People are using apps to hail cars, but that may reflect a snubbing of taxis and rental companies, and in the case of Saudi Arabia, simply a desire by women to move around freely.

It is not evident that most or even a large plurality of us wish a life entirely liberated from the wheel, at least not yet.

Part III: But if ride-sharing does take off, will Uber win?

The settled view remains that car-sharing will take hold more or less alongside autonomy. So out of respect for its advocates, let’s conduct a thought exercise: Will Uber then conquer the global market, as has been suggested by analysts, and more specifically by its valuation?

Here, too, there is logical dissonance. The assumption implies that the disruptees—the carmakers who must lose if Uber is to win—will sit more or less idle while their future is diminished or even foreclosed; that, like other once-dominant incumbents in other technology-driven industries (Kodak and Nokia come to mind), the carmakers will flail heedlessly, or at least impotently, while a potent new technology captures their business.

For the automakers, the nightmare visage is an Amazon-like gargantuan to which they become beholden, an all-but impassable global gatekeeper for the sale of their vehicles. Within just a few years of its launch in 1994, Amazon was already starting to dominate book sales, weigh heavily on publishers, and put bookstores out of business, all the while keeping about half the list price of hardcovers it sold. Today, Amazon effectively calls the shots.

In the carmakers’ scenario of Hell, they, just like the booksellers, would become mere cogs or, worse, redundant, because who really cares what car picks them up—a Corolla, a Fusion, a Tucson—as long as it is clean and comfortable, and the driver reasonably courteous? Uber would be the branded platform, and the cars so many faceless nothings. Some say the seeds of this future are here. “Uber is already the winner in many countries in a winner-take-all industry,” said Jay Ritter, a prominent expert on IPOs and asset pricing at the University of Florida.

Only, the major automakers are visibly mobilized in focused counter-revolution, intent on preventing their dystopian fate.

Consider GM. Four years ago, this US giant was ahead in early electrics, having launched the path-breaking plug-in hybrid Volt, which gave it the type of estimable street cred it had lacked since perhaps the stylish Camaro in the late 1960s. Yet it was a tenuous lead, and one that GM itself seemed not to know what to do with. When presented with the opportunity to run with its advantage by, say, acquiring advanced battery companies, GM refused. In interviews at the time, GM executives said the company made cars, not batteries; it needed to husband its scarce resources.

In 2016, GM has had a re-contemplation. Uber’s sweep across the planet, along with the success of Tesla Motors, spurred a $500 million GM investment in Lyft and a decision to pony up another $1 billion to acquire Cruise, a San Francisco-based self-driving technology startup. (GM is also preparing to release its new, 200-mile-range, pure electric Bolt by the end of this year.)

May was a big month for similar tie-ups. BMW, Toyota, and Volkswagen all bought stakes in ride-hailing companies (respectively, in a California startup called Scoop, in Uber, and in Israel’s Gett). In July, Daimler merged its MyTaxi subsidiary with a rival called Hailo, and then led a fresh investment round in an app-based limousine service called Blacklane. Taken together, the automakers appear to be muscling up, attempting either to emerge with a clear lead themselves, or at least to mold a friendly future in which they are one of several car-sharing winners.

Amnon Shashua, chairman of Mobileye, a leading autonomous technology provider, predicted in a July 26 earnings call that most of the carmakers will morph into “mobility companies,” and supplant today’s standalone ride-hailing firms. “There will be nothing special about Lyft and Uber and Gett in the longer term,” Shashua said.

The barriers to entry for ride-hailing companies can be quite low. In many places, all you need is a smartphone and a mobile credit-card reader, and you are on your way. The trick is to get enough people to download your app and drivers to satisfy the demand. Numerous firms have managed to do this. Lyft has thus achieved a $5.5 billion valuation, India’s Ola $5 billion, and Didi Chuxing $35 billion, including the Uber business it just absorbed.

The competition is cutthroat, though. To get and keep market share, the ride-hailing rivals are continually dropping their fares, even while awarding bonuses to cement driver loyalty. In December, Lyft and three Asian startups—Ola, Didi, and Grab—formed an alliance to beat Uber on scale and convenience, pledging to allow passengers to cross-use their apps in Asia and the US.

On June 21, Andrew Ross Sorkin at The New York Times wrote that Uber’s feverish pace of fundraising seems at least in part a calculated attempt to crush this savage competition by crowding out investment available to the others. The argument is that individual winners will eventually emerge in each market, and then command higher, profitable fares.

If so, the strategy does not seem to be working, at least not yet. That has been most plain in China, probably the most important market in the world. Over the last two years, Uber and Didi fought a ferocious battle, with Uber alone spending $2 billion to retain drivers and subsidize fares. Even so, Didi ended up controlling at least 80% of the market before forcing Uber to succumb. The American startup sold its Chinese business for an 18% stake in Didi, which in exchange obtained a $1 billion equity stake in Uber. While not a bloodletting, it was a far cry from the triumph many expected from Uber.

Just a few days later, Didi showed that it does not regard the deal as a truce, joining a $600 million funding round for Grab, a strong rival with a network around Southeast Asia. The move seemed to suggest that Didi has globe-conquest aspirations of its own.

Part IV: A successful short requires at least two things

The first documented appearance of a shorting strategy goes back to 1609, when an Amsterdam merchant named Isaac Le Maire hatched an insider plot to depress the share price of the Dutch East India Company. Le Maire’s scheme was foiled, but he prefaced the image of short-sellers as underhanded predators or, conversely, vultures.

The targets of short bets are almost never happy about the nonbelievers who practice this dark art, and so have sought at various points in history to ban it. But short-sellers often are innocently hedging an outsized risk or agnostically doing what they are good at, making them part of a healthy, balanced market that includes all kinds of bets. At the end of July, shorts amounted to 27.9% of Tesla’s total shares, 9.4% of Twitter’s, and just over 1% of Facebook’s.

Which brings us to a couple of questions: If you happen to be a short-seller, is there a reasonable risk-reward case for challenging the considerable consensus—for betting against Uber? And if so, could you do it?

We start with the two simple rules governing the successful short: You need superior information, and a high trading volume so you can sell your position fast. If you have one but not the other or, worse, neither—if the situation is opaque, and there are only a few buyers and sellers—you are on perilous ground attempting a short bet.

With Uber, you have a singular brand with a credible story. The question is whether that brand and that credibility, plus the other assets on Uber’s balance sheet, add up to $62.5 billion. Here is a business under siege by rivals big and Lilliputian, in the midst of a cannibalistic pricing race to the bottom, bleeding cash and losing money while battling well-heeled, technologically savvy incumbents displaying every intention of owning the space themselves.

Notwithstanding how often it is repeated, the central Uber thesis—that half the population will eschew car ownership, and that we will be surrounded by robotic taxis by the early 2030s or so—is not in fact axiomatic. Uber does have a solid business, but it is not manifestly a new Amazon, Facebook, or Google, a behemoth poised to sit athwart the next big thing. It could reasonably end up as merely a more massive Hertz with a better phone app, albeit one that delivers sushi or enchiladas from the local restaurant.

Uber, which declined to be interviewed for this story, raised an impressive $2.7 billion in its first five years. The financing came from an increasingly feverish crowd of Silicon Valley venture capital firms, as well as individual technologists like Amazon founder Jeff Bezos, and US private equity funds. But that has been nothing compared with the 18 months since. The figures are not definitive because of Uber’s opacity, but, with its latest haul of leveraged debt and equity provided to Didi Chuxing, it has raised approximately $13.5 billion since the end of 2014, which accounts for 83% of the money attracted in its seven-year history, while increasing its valuation by 50%.

This leap for Uber has been funded by a new kind of investor. Uber had its last orthodox fundraising round—involving mainly VCs and private equity funds—in December 2014. Since then, its cash has come largely from the sale of debt and investments by either the well-heeled clients of investment banks or petro-state sovereign wealth funds. Qatar invested an undisclosed sum. Saudi Arabia put up a whopping $3.5 billion, and Russian oligarch Mikhail Fridman has thrown in $200 million.

But that is not all. More cash has come via Uber’s push into subprime lending. In May, Uber raised $1 billion from Goldman Sachs and five other banks to create a subsidiary called Xchange, a car-leasing firm for drivers otherwise unqualified to receive an auto loan. To obtain a car through Xchange, Uber drivers pay 11.6% interest, almost five times the standard US rate. When drivers do not keep up payments, Xchange hires repo men to collect the cars.

The creation of Xchange injects a new dimension of financial risk into Uber’s business, one endemic to subprime lending, and a reputational one as well. At once, it is not only the sleek and courteous ride-hailing business of its legendary early years, but now one that repossesses cars from deadbeats.

In most successful investments, everyone earns a very good return, from the early, visionary risk-takers forward. So it will likely be with Uber, whose early investors seem poised to make a phenomenal profit in an IPO. If you invested $10,000 in the Series A round in February 2011, it would be worth about $10 million if Uber were to go public at today’s valuation.

But that is only if that valuation holds. If it doesn’t, protection clauses meant to attract late-round investors paying the sky-high valuation rate should insure them their money out first in any IPO or acquisition of the company, in addition to other safeguards in case of a catastrophic plummet of value or bankruptcy. In that type of a squeeze, the losers would be holders of common shares—meaning ordinary Uber employees—and early investors, who while receiving a healthy return would stand to profit less, perhaps considerably less, than the current valuation would suggest.

Among those in Series A and B was Benchmark Capital’s Bill Gurley. In April, Gurley wrote a 5,600-word blog post that, although mentioning Uber once in a complimentary way, reads like a thinly veiled tirade against the startup’s more recent investors. In the post, Gurley, who declined to comment for this story, grouses about the exploitation of “high-flying” unicorns (startups with valuations of $1 billion or more) by “sophisticated and opportunistic” late-round investors who swoop in and impose “dirty” terms that can hurt everyone else, and put the startup itself at risk. The post followed a year of rants about the failure of high-value startups to go public.

No wonder, because Uber investors are starting to lose faith in the current valuation: Six of the 16 mutual funds that own Uber shares have appraised them at prices implying a lower valuation, according to data compiled for Quartz by Morningstar. In regulatory reports filed from March through May, Putnam and Optimum assessed their Uber holdings at prices 10% lower than the going valuation, Morningstar said. John Hancock reported its shares at 7% below. Most of the mutual funds bought during earlier rounds, so their holdings are still in the money. But that is not the case for T. Rowe Price, which obtained shares at the December 2015 peak; just four months later, T. Rowe Price marked those holdings down by 6%.

Skepticism over Uber’s valuation goes back to at least 2014. At the time, the valuation stood at $17 billion, and a New York University professor named Aswath Damodaran decided to do his own calculation. When Damodaran, a valuation expert, was done, he published a blog post in which he said Uber was worth about $5.9 billion and shared a template allowing anyone else to try their own calculations, which a lot of people did.

Benchmark’s Gurley, commenting two years before his outburst about late investors, took umbrage at Damodaran’s assessment, arguing that mere figuring sometimes doesn’t get you to true value. Damodaran redid his numbers (here is his new spreadsheet), and in October 2015 raised his estimate to $23.4 billion. Only, by then, Uber’s official valuation was $51 billion.

What does Damodaran think now that Uber’s valuation has climbed to $62.5 billion? “Nothing in the news suggests that Uber has transformed itself into a money-making machine since October and my value would not therefore change either,” he said in an interview—and that was before the Didi deal. In other words, Damodaran estimates Uber at about a third of the valuation suggested by the company’s most recent investment rounds.

Of course, mutual funds have lowered their pricing for many of the “unicorns,” the hallowed group of roughly 150 pre-IPO Silicon Valley startups worth more than $1 billion, their value pumped up by a rush of investment in 2014 and 2015, of which Uber is the biggest. Fidelity, one of the largest mutual-fund firms, marked down Snapchat by 25% last November, and Dropbox by 38% in March. The worst hit is DraftKings, a fantasy sports startup that was cut an average of 72% by mutual funds in the fourth quarter last year (paywall).

Most of the mutual funds did not mark down Uber’s value in the last go-around. But that more than a third of those funds have rejected the $62.5 billion valuation suggests that Uber might be confronting its upper limits, or might already be there; it seems unlikely to attain a higher pre-IPO valuation, particularly with its setback in China, and some shareholders doubt the heights it has already reached, and possibly the story that got it there.

Part V: All this matters only after an IPO—or does it?

Young, private companies are traditionally difficult to short. The shares are held by either the founders, employees, or investors, and while some startups are fairly liberal in allowing their shares to be traded—allowing employees, for instance, to sell some shares so they can get married, buy a house, and generally get on with their lives outside of work—many are not.

Uber is emblematic of the latter case, prohibiting the secondary sale of its shares except in exceptional circumstances, when it reportedly will offer to buy at a valuation of its choosing. The message to Uber shareholders, including employees, is that they must by and large wait for an IPO.

In fact, an IPO is the best circumstance for a short-seller, too, at once creating the required dual criteria of much-enhanced financial transparency, and the liquidity needed to cash out fast. But when an Uber IPO will occur is an open question. Despite grumbling by important investors, CEO Travis Kalanick has vowed to put off going public as long as he possibly can, as much as a decade into the future.

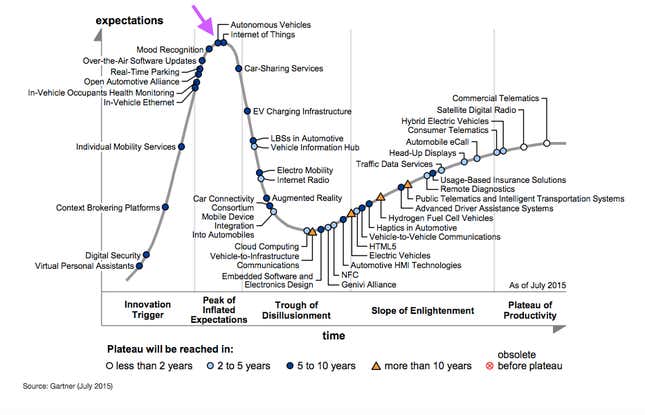

He may have legitimate business reasons for doing so. The Gartner Hype Cycle, a creation of the technology research firm Gartner, tracks the psychological heart of technological and commercial manias, the very sort of phenomenon that we appear to be observing in the form of the unicorns. Gartner says it hasn’t yet applied the algorithm to car-sharing, but has studied self-driving vehicles. According to this system, autonomous vehicles reached their “peak of inflated expectations” in July 2015 (see below). This means that, although no one seems to have noticed as yet, self-driving cars may be a year past peak hype, and just entering their long, sad “Trough of Disillusionment,” the plunge when you learn that your plans won’t unfold precisely as you thought, and the world laments why it ever believed.

During the trough, there can be a public loss of faith—which means that if Uber goes public at almost any time during the coming half-decade, its current valuation could encounter very serious resistance, not to mention the vast increase that its financial backers would almost certainly demand to justify their risk.

Hence, if Kalanick worries about Uber’s valuation coming under attack, there would be merit to waiting. Almost no one believes that he can postpone an IPO for very long—in the end, Uber can behave as opportunistically as it does only because it has raised so much money, and the financiers who have made that funding available are eager to lock in their profit if not fully cash out. They will apply pressure for an IPO, as will Uber employees desiring some creature comforts. But Kalanick could compellingly argue that the potential for the erosion of Uber’s valuation would be too great in an imminent IPO.

If he did so, he would be making the case for a short. The question again would then be whether one is possible, and if so, how?

Part VI: So … can you short Uber?

When most people get into investing, they hope for the best but understand they are in a two-way bet. You can do well, but the market can conspire against you, too. That’s why, as the Uber enthusiasm has continued to rage, it has begged the question of whether anyone is shorting it—and if not, whether they should. Is Uber really a sure thing?

When I asked around, most experts seemed bewildered that anyone would want to try to short Uber. Other unicorns had their problems, but Uber was one of two or three examples of the gold standard of value. Again and again, I was reminded of the obstacles, especially that Uber all-but bars trade in its private shares. If an IPO occurs, you could short Uber then. Meanwhile, if you were interested in making money on the company, the only thing to do was to invest in it yourself, as some wealthy individuals had done in recent months; otherwise you could just watch the magic. Yet, always somewhere in the background lurked the memory of cycles in our recent past—the go-go ’90s, followed by the dotcom crash; the go-go ’00s, succeeded by the financial crisis.

While financial manias are not new, their bruising results used to humble financial actors, and the recurrence of such crazes would be separated by decades and sometimes a century (nine decades in the case of the tulip and South Sea bubbles, for example). But the housing bubble appeared just a few years after the dot-com bubble; now, only a few years after the mortgage bubble, the unicorn boom has arrived with its exuberant (and arguably irrational) investors, higher and higher valuations, companies with incomplete narratives, and a greater stampede for the perceived prize. We are doing it again.

As it happens, there is a small camp of experts in the venture investment world with an ultra-skeptical eye on Uber.

“I’m not sure that Uber will matter in five years,” says Max Wolff, chief economist at Manhattan Venture Partners. “One lesson in tech is that it’s easier to disrupt a market than to reorganize it around yourself.”

But Wolff says that no one has figured out how to short the company. Indeed, the most direct nay vote for now might simply be not to buy Uber shares, he said. There are indirect bets—you could, for instance, buy shares of Medallion Financial Corp., which finances licenses for New York City taxis. If Uber and its ilk disappeared tomorrow, taking with them the major threat to the city’s yellow cab fleet, Medallion investors could do very well. You also might create a derivative that shorts the San Francisco real estate market, which in the past has boomed during big IPOs. But neither of these solutions is a true short, and could leave you well wide of the target.

The impression is that, whether deliberate or not, Kalanick is forcing the investing world into a one-way bet by foreclosing every other type of wager. Almost the entire unicorn class is doing so, largely by avoiding going public. In 2015, just five Silicon Valley unicorns had IPOs; this year, there has been only one: Twilio. The reasons they are by and large eschewing the public market include that, apart from Twilio, whose value has soared since the IPO, all the others, Square, Box, and Pure Storage among them, have suffered massive post-IPO devaluations.

So long as investors keep pouring in their billions, IPOs can be avoided. So can the severity of open-market scrutiny, and the often brutal treatment found on the public exchanges (see Twitter for an example of that).

In Kalanick’s case, if you are a believer that the future is robot car hailing, a still-private Uber is your ticket; if you aren’t, or see the future a bit differently, you have recourse—you can roll the dice and invest in something else. But otherwise, you can mainly stay out of Uber’s way.

Kalanick may not have the last word, though.

Part VII: When you ban something, you make it more tantalizing

One thing I eventually learned in studying Uber is that its shares are not as hermetically locked up as they appear to be.

Unlike a number of unicorns, Uber has resisted the opportunity to let its shares trade in the Nasdaq-traded Sharespost 100 Fund (PRIVX), a platform allowing private companies to organize the secondary sale of shares on behalf of their employees. Nor do its shares appear on any of the other conventional secondary exchanges. But as any drug agent will attest, black markets tend to spring up when the trade or movement of something is barred. This is effectively what has happened with Uber shares, only with legitimate middlemen serving as facilitators.

Firms with names like Equidate, EquityZen, and 137 Ventures have launched in the US and Europe, creating derivatives meant to bypass private company share restrictions. In what is technically known as a forward contract, deals done by such firms initially transfer the value of the shares—the upside and the downside—but not their immediate ownership; a transfer is contractually agreed to take place, but at a date typically only after an IPO.

It cannot be known definitively how many contracts tied to Uber shares have traded this way. Given Uber’s tough-talking lawyers, traders can go suddenly mute when asked whether they have done so. But such arrangements are popular with Uber shareholders because the company need not be notified, and so has no chance to block the arrangement, said Greg Brogger, CEO of SharesPost, a San Francisco-based secondary shares firm.

SharesPost doesn’t handle this specific type of transaction. Neither does Equidate, founder Sohail Prasad said. But last year VSL Partners, a San Francisco middleman firm, apparently served at least one Uber shareholder (paywall), although according to The Wall Street Journal, VSL’s website abruptly removed Uber’s name from its list of pre-IPO shareholder clients. Remarking on the story on his blog last year, VSL founder Dave Crowder did not challenge the facts of the Journal report, and instead lamented that some unicorn founders, by locking up shares, are failing to respond to their employees’ needs for cash. (Crowder did not respond to our requests for an interview.) Additional Uber shares trade in the shadows, according to two traders who told me on condition I did not identify them, worried about trouble from Uber.

The unintended consequences of giant unicorns staying private even as employees or other investors seek to sell off some of their stock could be the conditions for a very different market—an expansion of the secondary exchanges, where shares could be traded in the manner of most stocks, including long, short, and all sorts of other bets. Equidate’s Prasad said his goal is just that: to be “the stock market for private companies,” with ample liquidity and the right to short, although he is far from it at the moment, forcing most clients to hold what they’ve bought for at least six months.

There are deep skeptics that such a private market could fully form, mainly because the startups will resist, thus potentially starving the exchanges of shares to trade. One of the chief opponents presumably will be Uber, among the most opaque of the unicorns, releasing financial detail only as it sees fit, and abetted by eager investors who, if they are insisting on greater transparency, haven’t received it.

Brogger, the SharesPost executive, cautioned that the paucity of financial data could in any case make an Uber short “not a healthy development because it would be so speculative and ripe for abuse.” The US Securities and Exchange Commission has already stepped in to say that the secondary industry, despite being private, may be subject to federal regulation.

The exchanges’ coming to life shows that the shares cannot be simply bottled up, not with employees and early VCs clamoring to cash out at least some of their holdings. The challenge will be for firms like Equidate to create the necessary superstructure for the short, or for the financial geniuses to engineer a workaround. History suggests it will happen. But if you want to bet against Uber right now, this is not your play.

Part VIII: The Big Short

I kept thinking about the simple timeline of Uber’s seven-year funding bonanza, and a detail stood out: That Kalanick has not only sold shares to raise his war chest, and embraced subprime loans. He has also raised $3.4 billion in debt from Wall Street investment banks, in the form of leveraged loans and in bonds that on maturity convert to Uber shares. In turn, the banks—Goldman Sachs, Morgan Stanley, and Bank of America-Merrill Lynch, all of whom declined to comment for this story—have reportedly sold either all or most of the debt on to clients.

Derivative contracts covering the bonds would be something over which Kalanick could not exercise his authority. And they thus offer another potential way to counter-bet on Uber. You could short the debt—right?

I thought back to Lewis’ book The Big Short and its unforgettably idiosyncratic characters, who in the 2008 financial crash figured out how to profit off cocky Wall Street bankers. Their target: high-risk mortgage-backed derivatives known as collateralized debt obligations. And their weapon of choice: credit default swaps (CDS).

I decided to look at CDS as a possible path to shorting Uber.

“The easiest way to understand them is to use an analogy: term insurance,” Robert Jarrow, a finance professor at Cornell University, told me. But instead of insuring your life, you are covering the value of a bond sold by a company or a government. “You will pay premium payments every quarter,” Jarrow explained. “And if the bond loses value, or defaults, the CDS will pay you the value of the bond.” Or, if someone becomes desperate for insurance, the CDS could sell for much more.

The CDS contracts specifically employed by the characters in The Big Short were referred to as naked, because the buyers did not actually own the underlying bond; it was like taking out that term insurance on someone else’s life. I considered whether Uber bears could use those, too.

I did not discover definitively whether any CDS contracts have or haven’t been written on Uber—if there were any, their existence wouldn’t need to be made public. But it did not seem likely. As with the secondary markets, finance experts expressed serious reservations about using CDS to short Uber. You might be the only person carrying out this bet, they warned. You might not find a reliable counter-party to take your bet at all, and possibly be on the hook if the company defaulted or otherwise triggered a payout. The fees charged by any bank for this service would be costly and go on for a long time, and the transparency regarding the value of the CDS would be minimal. ”They talk about this a lot in The Big Short, and how even when it was clear everything was screwed, the banks kept pricing the CDS as if nothing was wrong,” said Kunal Shah of ShortInsider, a New York-based data firm.

Again, this was a highly dissatisfying reality if you happened to be an active Uber skeptic.

Yet the target remains so tantalizing. With the Didi Chuxing transaction, Uber has stanched its billion-dollar-a-year bleed of cash in China, but it has continued to spend an equal sum to capture India, along with money for subsidies and price-cutting elsewhere as new rivals arise in Africa, in Europe, and so on. It has also found new ways to deplete its $10 billion war chest—including a reported $500 million and growing to create a proprietary global mapping system to guide its robots. And now Didi, fresh off its victory over Uber in China, is challenging the American firm with a reported plan to invest in Grab, an Uber competitor across Southeast Asia.

Should Uber require another cash raise, these factors plus the doubts expressed by the mutual funds would probably generate resistance to a fresh jump in valuation. Uber would face pressure to accept a “down round,” a valuation below $62.5 billion, perhaps far below. Even then, it is not clear where Uber would turn for its next billions, apart from digging itself deeper into debt, and hiving off more equity to petro-states, Russian oligarchs, local international rivals, or other investors atypical in Silicon Valley.

Some analysts have begun to temper their enthusiasm, scrutinize the substantial complexity of safe, driverless mobility, and suggest that the expectations of ubiquitous robot vehicles could be wildly premature. In a July 28 note to clients, Jonas, the Morgan Stanley analyst, challenged even the moderate view that robot cars will be “the dominant form of vehicular transport” by 2035. He said that conventional cars will keep improving, and that the 1.2 billion-vehicle global fleet may need to turn over several times—to go through the entire, approximately 14-year cycle of manufacture-through-the-scrap-heap—before the world gets there. Mainstream use of these cars might not arrive for many decades, far longer than any reasonable investment outlook.

If so, Uber’s most recent valuations could seem absurdly rich. It still could go public, but at a humbler valuation than its latest funding rounds suggest. And in that case, there may be no obvious way to make a killing betting against it, since Uber will in effect have swallowed the harsh medicine itself. It would be a huge comedown—far bigger than its failure in China.

That’s why Uber will be highly motivated to go public as the gonzo alpha we see today. And if it does, it will confront two storms it has yet to face: the open market and—quite possibly—short sellers.